A Place to Live or an Investment?

A home is both a residence and an investment. The real estate market can be a great place to put your money. Buying at the right price, obtaining a historically low rate, or refinancing when the math makes sense, can boost the chances of a real estate purchase becoming a great investment over time. Owning a home allows you to build equity, profit from any price appreciation, and possibly benefit from tax perks related to deductions for mortgage interest and property taxes. As with any investment, your home should be one part of a diversified portfolio that includes retirement accounts, an emergency fund, and other assets with appreciation potential, such as stocks and bonds.2

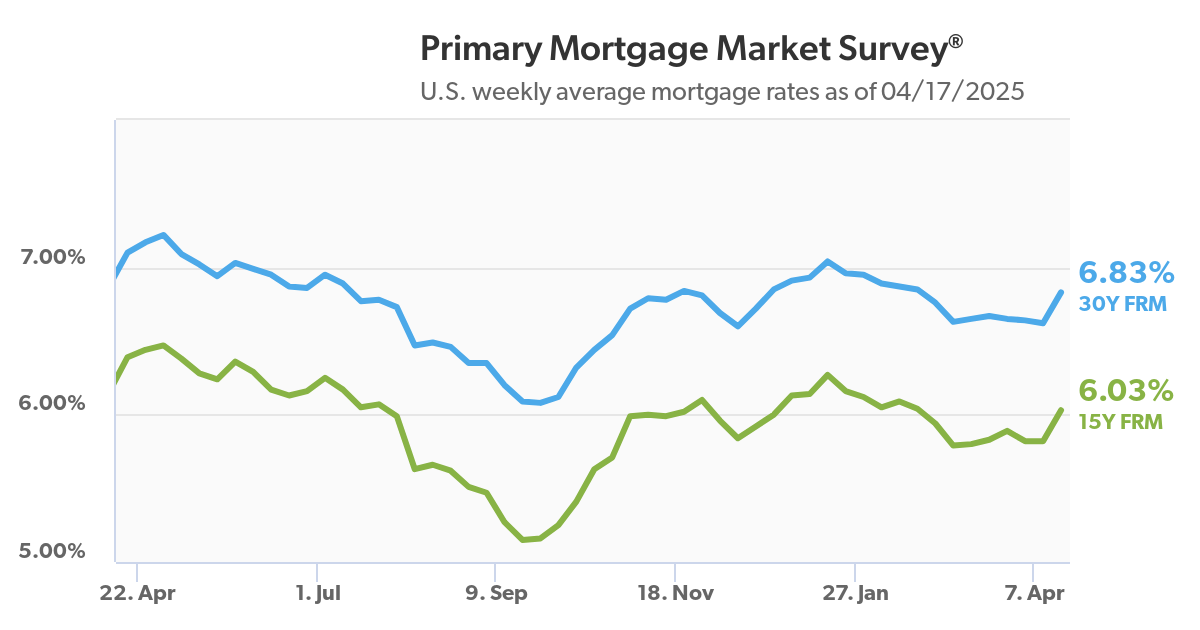

Is Saving $100 a Month Worth Refinancing?

Refinancing can save you on your monthly mortgage and give your budget some extra wiggle room. But if you only save $100 a month, is it worth the expense and effort? Consider that your closing costs will likely total between 2% to 5% of your new loan's principal balance. On a $200,000 loan balance, that's a minimum of $4,000 out of pocket. Saving $100 per month, it would take you 40 months - more than three years - to recoup your closing costs. If you plan to stay in your home for four years or more, refinancing might be worth it.3

Buyers Seeking Walk-in Pantries

The walk-in pantry has become the most desirable kitchen feature for homebuyers, with more than 85% of homes larger than 3,500 square feet featuring one. Features of luxury pantries can include built-in shelves, quartzite countertops, hardwood floors, spice-rack pullouts, wine storage columns, and built-in lazy susans for added storage. Homeowners can find inspiration on Pinterest and Instagram to organize their food and kitchen items in a practical and visually appealing way.5

Sources: 2USA Today, 3The Mortgage Reports, 5Realtor Magazine

Recent Comments