Shorter Commutes Have Become a Low Priority for Home Buyers

According to a new report from Zillow, a desire for housing within arm's reach of the biggest downtown job centers in the U.S. are lessening as home buyers search for housing further from downtown locations. Housing closest to a city's downtown city center is generally the most expensive, but as Zillow indicated, many of the hottest downtown areas are seeing declining home values. With more people working remotely and enjoying the freedom to live where they choose, housing within a short commute is no longer a priority.1

Wealthy Gen Xers are Making Their Way South

Known as the richest generation, Gen Xers earn a median income of $113,300 and make up a quarter of home buyers. The high-earning generation is also on the move. New data released by the National Association of REALTORS® identified the top states where Gen Xers who earn at least $100K or more are moving. So where are they? Florida and Texas topped the list, maybe because of no state income tax? Other states on the list included the Carolinas, Arizona, Tennessee, Idaho, Colorado, and Washington. Warm weather seems to be a driving force for the top states as well.2

Most Searched Real Estate Keywords in 2021

With the current home buying frenzy still in full effect, the features and amenities buyers are seeking have changed thanks to the unforgettable year of 2020. Point2Homes examined 43 million words from 640,495 listings across the U.S. and came across some interesting finds. While the most searched keywords were not surprising with "home," "bathroom," "bedroom" and "kitchen," topping the list, the most popular home features and amenities were "garage," "walk-in closet" and "full bath." Their key findings indicated that lux amenities were on the rise as well, especially in the kitchen, and space was a priority more than ever before. All things "bonus" are attractive to buyers too, as well as "laundry room" and "home office."3

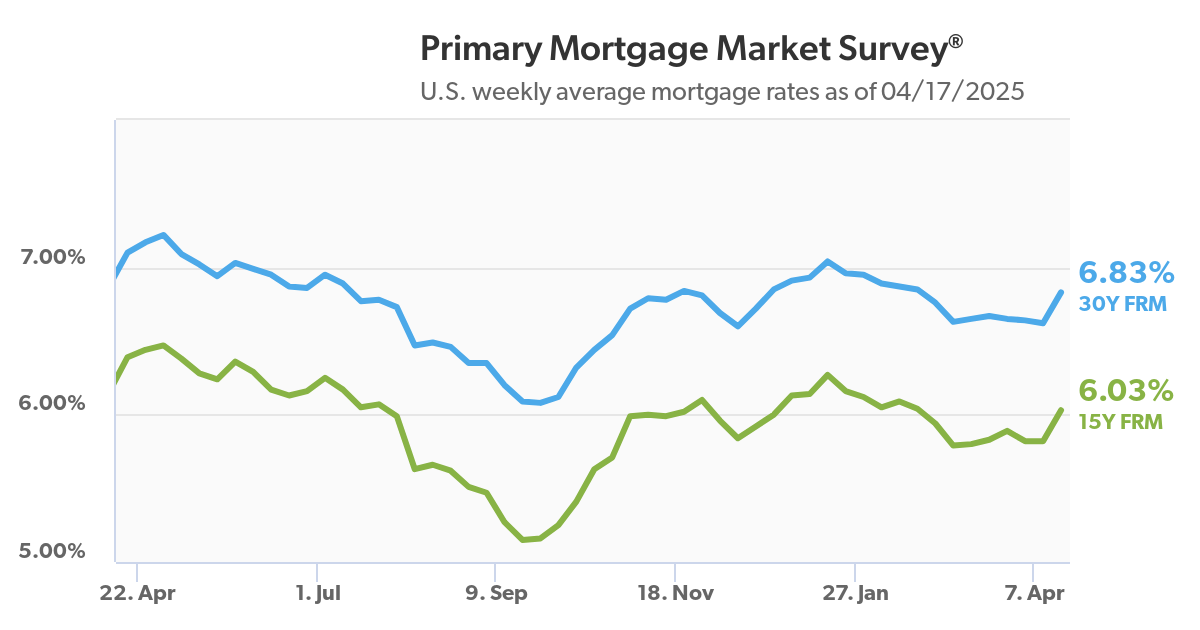

Decline in Bond Yields and Elimination of Refinance Fee Drops Mortgage Rates to February Lows

The 30-year fixed-rate average dropped for the fourth week to 2.78%, while the 15-year fixed-rate average decreased to 2.12%, according to the latest data from Freddie Mac. Rates are at their lowest level in months, as The Federal Housing Finance Agency announced the removal of the adverse market refinance fee, effective Aug. 1. The surcharge was put into place to offset pandemic-related losses suffered by Fannie and Freddie, but was not a pleasant welcome by home buyers, as it went into effect last December, during the pandemic. The other cause of rates dropping is the recent stock market sell-off that caused investors to turn to the safety of bonds, pushing prices to rise and yields to fall.4

Sources: 1dsnews.com, 2magazine.realtor, 3rismedia.com, 4washingtonpost.com

Recent Comments