Rent Prices Outrun Mortgage Payments Across the Nation

In past years, first-time buyers were motivated when they learned that their rent payments were actually larger than mortgage payments (if and when they made the decision to buy). However, during the past few years, this selling point disappeared as home prices and interest rates increased.

However, the tables have recently turned for many renters across the nation. A recent Zillow Home Loans analysis found that renters in over 20 metro areas could keep more of their monthly take-home if they buy a home.

For example, New Orleans renters paying an average of $1,652 in monthly rent could save over $400 if they buy a home. Other cities offering similar advantages include:

- Chicago, IL

- Pittsburgh, PA

- Miami and Tampa, FL

- Memphis, TN

- Cleveland, OH

- Detroit, MI

- Oklahoma City, OK

- Houston, TX

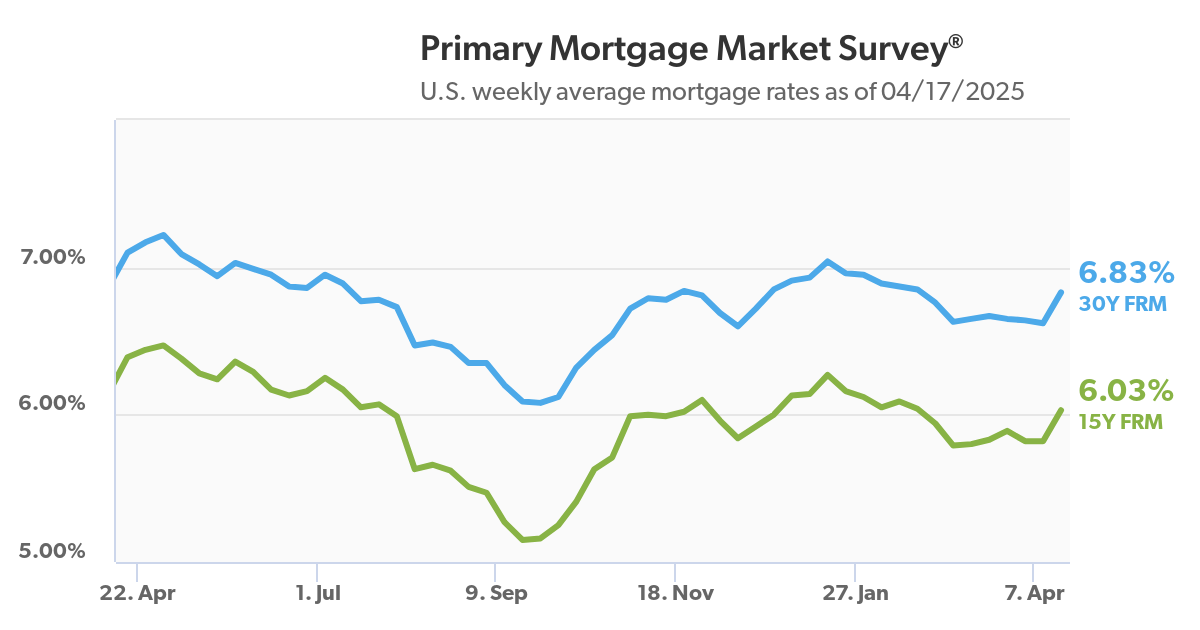

The Fed Reacts to Unemployment with a Super-Sized Rate Cut

Earlier today, the Federal Reserve announced a half-point cut to the benchmark interest rate. This lowered the key rate to roughly 4.8%, down from a 20-year high of 5.3% that had been in place for over a year because of inflation.

Inflation has fallen from a peak of 9.1% in mid-2022 to a three-year low of 2.5% in August, not far above the Fed's 2% target. However, many economists believe that the Fed's decision to go for a larger cut was partially influenced by rising unemployment figures.

The unemployment rate has risen nearly a full percentage point from its half-century low in April 2023 to 4.2%. While this is still considered low, it's feared that this number will continue to rise.

Today's rate cut is expected to lower borrowing costs for consumers, boosting their financial outlook and supporting more spending and growth.2

Do Solar Panels Increase Property Values?

As the nation experiences higher temperatures, more homeowners are going solar, and more buyers are interested. However, there's still some confusion about how solar installations may affect a home's value.

For example, some believe that appraisers ignore them. However, The Appraisal Institute offers education that focuses on residential solar installation.

Here are some things to keep in mind if one or more of your sellers has gone solar.

- Find out if your seller is financing the solar panels. While some homeowners pay cash or do a cash-out refinance to cover the costs, others may have had them financed.

- If your seller is making payments on their solar panel installation, this may cause problems, as the buyer may not be allowed to take over the payments. Be prepared to discuss this in detail with your seller.

- Ask your seller for copies of past utility bills, so you'll be aware of the value the solar installation will provide to the next homeowner. Ideally, they will have a "before and after" history, so buyers will see how much they can save.

- Check homeowners' insurance options. Not all insurers are as enthusiastic about solar as others.

- While tax incentives may be available for solar panels, these may vary by year. Ideally, your buyer will consult a tax pro or visit IRS.gov for details of each year's incentives.

Zuck's Meta Holiday Updates

Since the fall and winter holidays tend to sneak up on us, you may want to check out Meta's new updates for the season sooner than later. While most updates are designed to assist retail shoppers, such as in-store promotions, you may find others useful if you tweak them.

Meta is testing first purchase offers and personalized discounts. Reminder ads are also being updated, providing prompts that help you keep certain offers top of mind with your audiences and encouraging more engagement. Meta's also increasing the frequency of reminder notifications so you can work on raising awareness.

Site link options are also being improved. This will enable you to add multiple landing pages to a single image or video ad in your Facebook feed.

Meta's also adding a new way to target prospective tourists who are considering holiday options in your region. While the out-of-towners probably aren't shopping for a home, a few may decide to relocate...so it never hurts to be the first agent they see when checking out Facebook or Instagram for things to do.4

Tips for Supporting Community Causes

Be authentic with your choices. Choose an organization that you believe in. If you're concerned with literacy levels, you may want to encourage others to donate books to local schools. Enjoy cycling? Support groups that donate bikes to families who can't afford them.

Focus on what you can manage. Supporting a cause doesn't always mean donating large sums of money. Think of the other assets you (and your office, if applicable) have to share. For example, if you're a math whiz or speak a foreign language, you can help teach these subjects to those whose lives would benefit from learning.

Make it easy to participate. If you decide on a holiday-themed fundraiser, you can set up a wish list of items for the people (or animals!) that will be helped by the outcome. This creates several levels of participation, as some items will be cheaper than others.

Help promote other, similar fundraisers. If one of your clients mentions an upcoming event, or if you notice a neighboring business supporting a different charity, ask what you can do to assist. This could be as simple as a mention on your social media, or a sign in your office window.5

Sources: 1zillow.mediaroom.com, 2apnews.com, 3architecturaldigest.com, 4socialmediatoday.com, 5buffer.com

Recent Comments